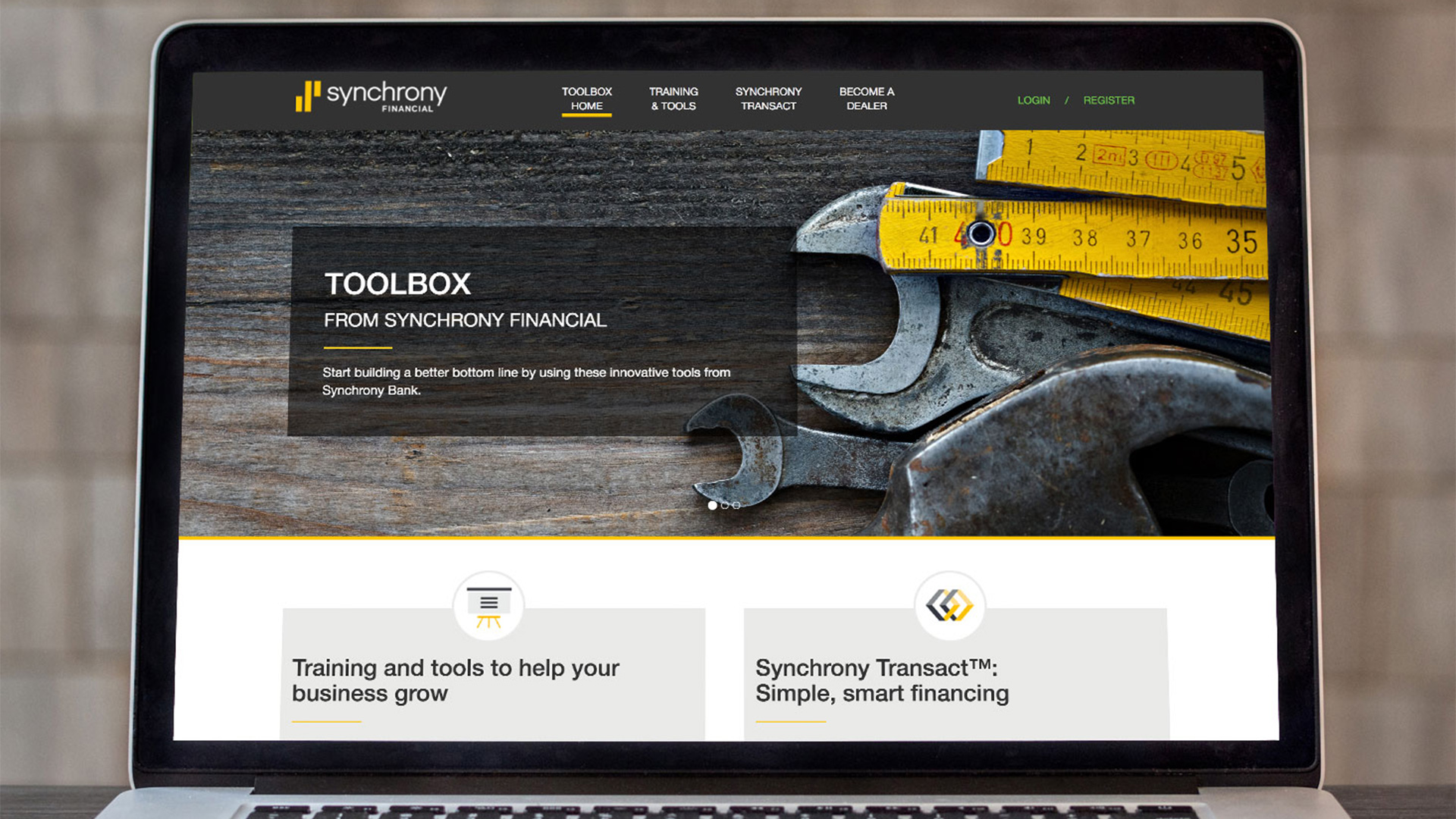

Dealer Activation Program

Synchrony Financial

Synchrony Financial is a leading provider of home improvement financing. But contractors sometimes feel uneasy talking about financing with prospective clients. Enter “Toolbox,” an integrated program that teaches contractors how offering financing can help grow their business.

Strategy

In providing consumer financing services through various types of businesses — from jewelry retailers to heating and air-conditioning contractors — Synchrony Financial depends on its “dealers” to explain and advocate the benefits of financing to their consumer clients.

Within its home improvement segment, Synchrony Financial results were falling short. Among its more than 17,000 contractor dealers, only about 20 percent were consistently generating a significant volume of loan applications.

The company faced a double financial hit: Application fee and interest revenues from this key reseller audience significantly trailed projections, while the company’s substantial investment in dealer recruiting and training went largely unrewarded.

Solution

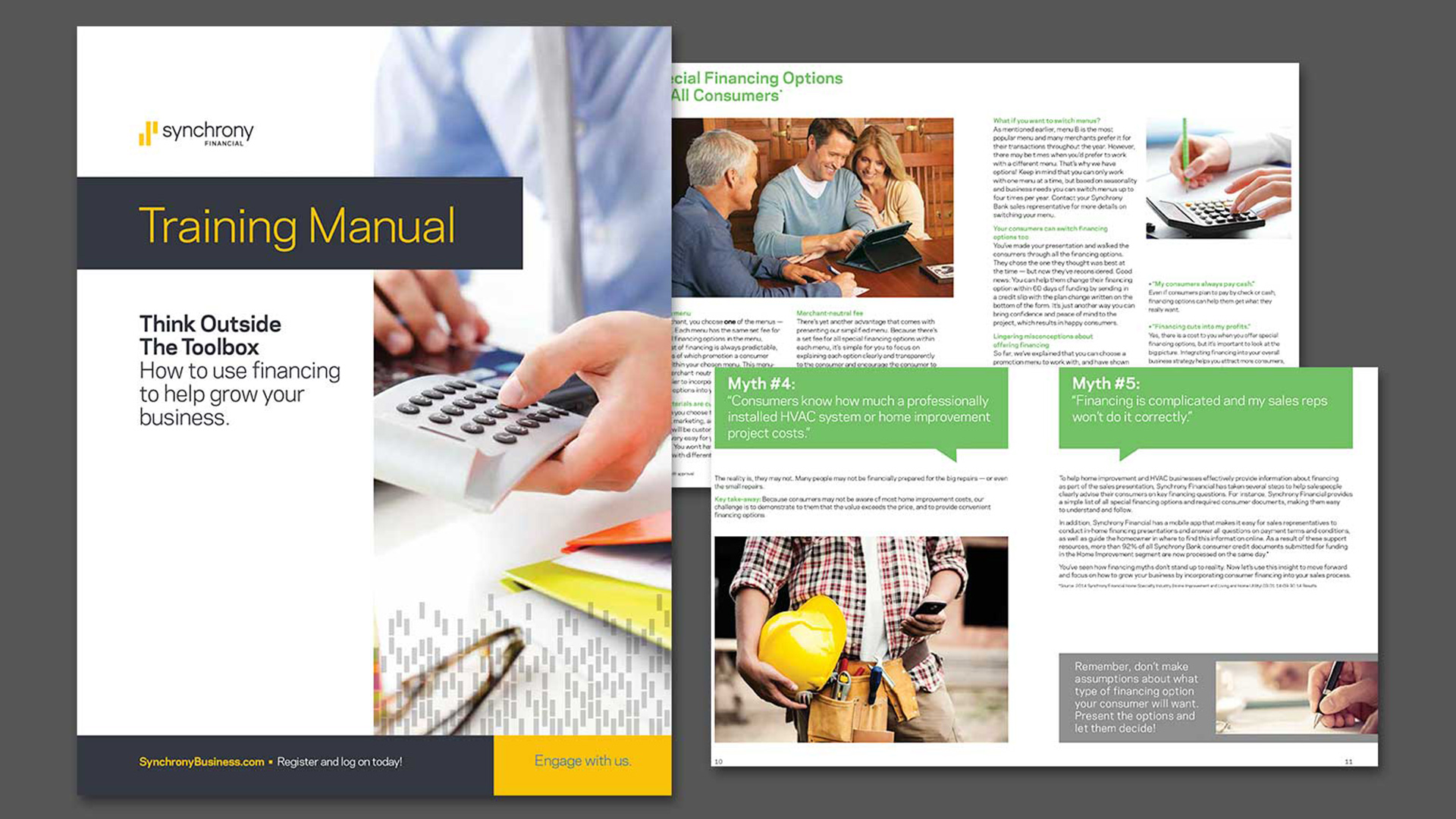

Seeking insights before answers, Synchrony Financial and Hanley Wood Marketing agreed to conduct research into why contractors were underperforming expectations. One-on-one interviews revealed:

- Most got into their work to help homeowners and master a trade, not to push papers and “sell financing.”

- Many, working 80 or more hours per week, couldn’t imagine what “grow your business with financing” might mean, given their already scarce time for family, friends and pastimes.

- Some fiercely desired to become super-successful entrepreneurs, but needed to be shown how financing can be a best-practice accelerator to business growth.

From these and other insights, we proposed a repositioning and content strategy.

- The program: Leverage primarily digital channels to invite contractors to explore informative, inspirational webinars on the effective use of consumer financing.

The promise? Rediscover the value and ease of offering financing — but do so on your own, highly individualized terms.

Outcome

Within a few months after program launch, nearly 7,000 contractor dealers had invested at least an hour of their valuable time to reacquaint themselves with financing’s relevance and utility.

For those looking to bring MBA rigor to their firms, embedding financing in the sales process became mission critical. For those working interminable hours, financing enabled selling bigger projects so they could earn the same or more by working the same amount of time or less.

By 18 months, more than 12,000 Synchrony Financial dealers had consumed the content, triggering a substantial upswing in consumer loan activity.

The value-adding, results-producing content strategy resonated so strongly with Synchrony Financial, they asked us to translate it for other dealer verticals.